Alginor ASA Announces Successful Private Placement Raising NOK 400 Million

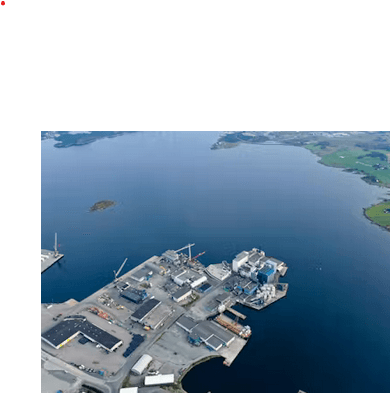

Funding to accelerate construction of first commercial biorefinery at Avaldsnes

Haugesund, Norway — 19 June 2024: Alginor ASA (“Alginor” or the “Company”) is pleased to announce the successful completion of a private placement raising approximately NOK 400 million in gross proceeds through the issuance of 11,111,112 new shares at a subscription price of NOK 36.00 per share.

The proceeds will be used primarily to finance the expansion of Alginor’s first commercial biorefinery processing lines at Avaldsnes, Norway, as well as for general corporate and development purposes.

CEO Statement

“We are very pleased to have completed this successful private placement amid uncertain market conditions,” said Kjetil Rein, CEO of Alginor ASA. “The strong participation from new high-quality investors and continued support from existing shareholders provide us with the confidence and capital to take the next major step — establishing our first commercial biorefinery lines at Avaldsnes. This marks a crucial milestone in our journey to becoming a leading supplier of sustainable bio-based ingredients to global industries.”

Transaction Details

- Gross proceeds: NOK 400 million

- Offer Shares: 11,111,112 new shares

- Offer Price: NOK 36.00 per share

- Lead Manager and Bookrunner: ABG Sundal Collier ASA

- Legal Counsel: Schjødt

The private placement attracted strong interest from both existing and new investors. Notable participants include Borregaard, the European Innovation Council (EIC), Jakob Hatteland Holding AS, and Must Invest AS, all of whom received allocations or had pre-commitments in the transaction.

Conditions for Completion

Completion of the private placement remains subject to the following:

- Approval by Alginor’s Extraordinary General Meeting (EGM), expected on or about 4 July 2024

- Full payment of the subscription amount for all Offer Shares

- Registration of the share capital increase in the Norwegian Register of Business Enterprises, followed by registration of the Offer Shares in Euronext Securities Oslo (VPS)

Conditional allocation notifications will be distributed to investors on or about 19 June 2024, with payment due around 5 July 2024. Delivery of Offer Shares will take place as soon as possible following the EGM and required registrations.

Planned Subsequent Offerings

Alginor intends to conduct a subsequent repair offering of up to 2,361,112 new shares, raising up to NOK 85 million at the same offer price of NOK 36.00 per share.

The repair offering will be directed toward existing shareholders as of 12 June 2024 (recorded in VPS two trading days later) who:

- did not participate in the private placement; and

- are not residents in jurisdictions where such an offering would be unlawful or require additional filings.

Over-subscription and subscription without rights will be permitted.

Additionally, Alginor may conduct a supplementary offering toward Borregaard to maintain its 35% ownership on a fully diluted basis, in accordance with existing shareholder agreements.

Conditions for Subsequent Offerings

The subsequent offerings are contingent upon:

- Completion of the private placement

- General meeting authorization for the board to execute the offerings

- Board approval

- Publication of a national prospectus, expected on or about 24 June 2024

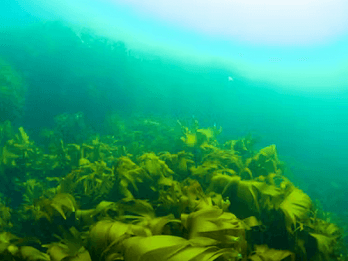

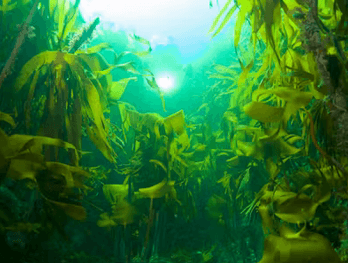

This successful NOK 400 million placement marks a major financial milestone for Alginor as it moves decisively toward the industrialisation of Laminaria hyperborea biorefining and the commercial launch of sustainable marine-derived ingredients.

- Alginor

19.06.2024