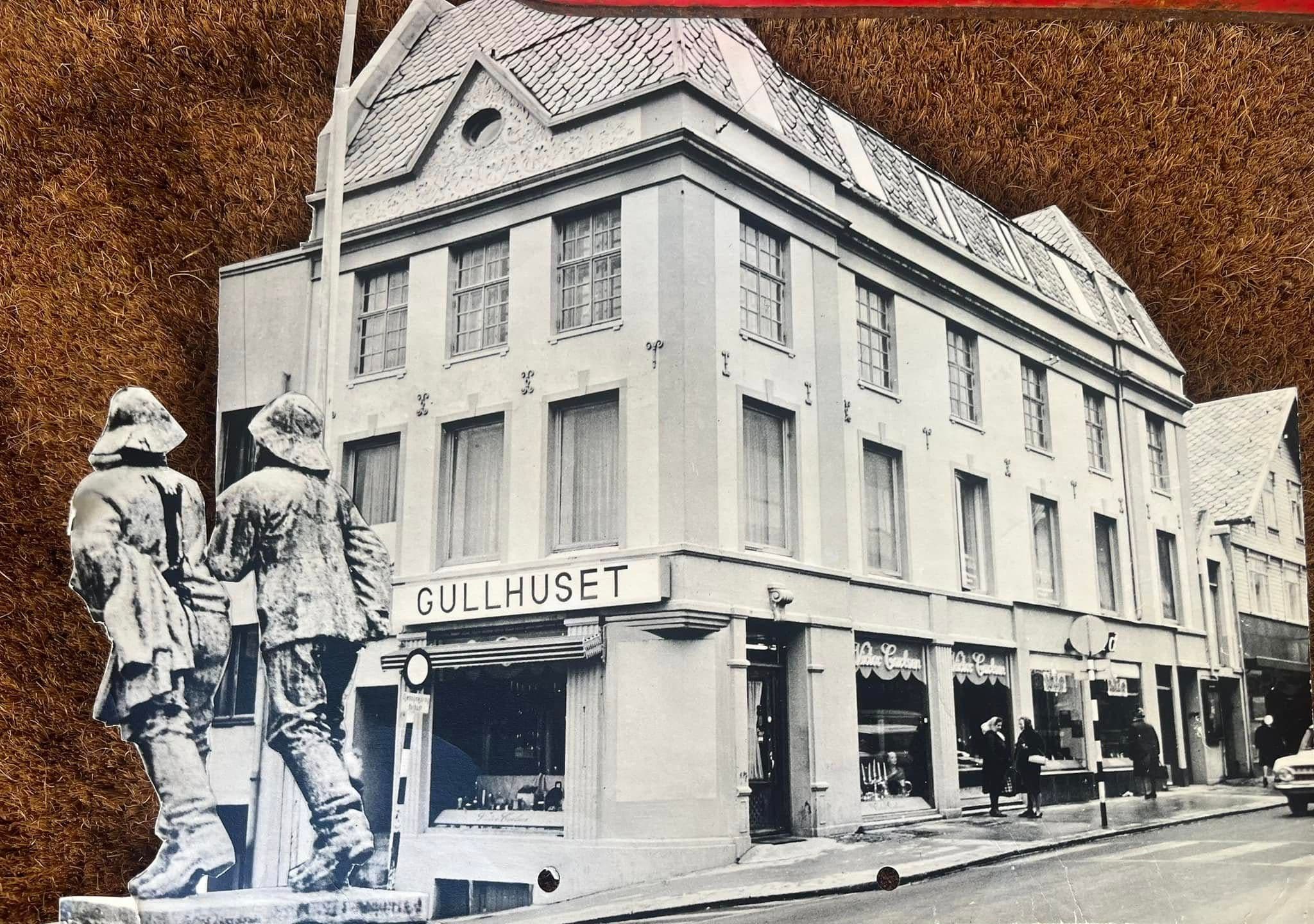

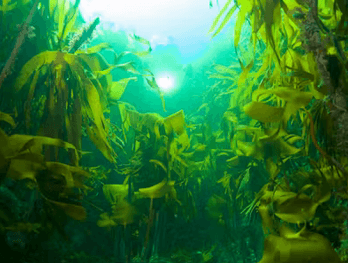

Alginor ASA: Subsequent Offering Following NOK 100 Million Private Placement

Subscription period opens 25 June 2025; shareholder overview updated as of 18 July

Haugesund, 18 July 2025 — Alginor ASA (the “Company”) announces the conclusion of its NOK 100 million private placement and the launch of a subsequent offering (the “Subsequent Offering”) to ensure equal treatment of shareholders.

At the extraordinary general meeting (EGM) held on 31 March 2025, Alginor resolved to raise NOK 100 million through the issuance of 10,000,000 new shares at a subscription price of NOK 10 per share in a private placement directed towards the Company’s largest shareholders (the “Private Placement”).

Following completion of the Private Placement, Alginor will now conduct a Subsequent Offering of up to 5,000,000 new shares at the same subscription price (NOK 10), targeting gross proceeds of up to NOK 50 million.

Subsequent Offering Details

- Offer size: Up to 5,000,000 new shares

- Subscription price: NOK 10 per share (same as in Private Placement)

- Gross proceeds: Up to NOK 50 million

- Subscription period:

Opens — Wednesday, 25 June 2025

Closes — Friday, 4 July 2025, 16:30 CEST - Eligible shareholders:

Shareholders of record on 31 March 2025, as registered in Euronext Securities Oslo (VPS) two trading days later (2 April 2025), who:- Were not allocated shares in the Private Placement; and

- Are not residents in jurisdictions where participation would be unlawful or require additional filings (outside Norway).

The Subsequent Offering allows eligible shareholders to maintain their pro rata ownership and participate on equal terms with the investors from the earlier Private Placement.

Prospectus and Subscription Process

The offering and subscription procedures are fully described in the national prospectus dated 21 June 2025 (the “Prospectus”).

The Prospectus is available on ABG Sundal Collier’s website

- Alginor

24.06.2025